Life Insurance in and around Littleton

Get insured for what matters to you

What are you waiting for?

Would you like to create a personalized life quote?

- Littleton

- Denver

- Lakewood

- Evergreen

- Highlands Ranch

- Roxborough

- Conifer

- Arvada

- Englewood

- Colorado Springs

- Fort Collins

- Grand Junction

- Salt Lake City

- Scottsdale

- Phoenix

- Norman

- Tulsa

- Oklahoma City

- Tucson

- Vail

- Steamboat Springs

- Boulder

- Broomfield

- Parker

Check Out Life Insurance Options With State Farm

There's a common misconception that Life insurance is only needed when you get older, but even if you are young and a recent college graduate, now could be the right time to start thinking about Life insurance.

Get insured for what matters to you

What are you waiting for?

Wondering If You're Too Young For Life Insurance?

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With coverage options from State Farm, you can lock in outstanding costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent Travis Rodgers or one of their understanding team members. Travis Rodgers can help design an insurance policy adjusted to fit coverage you have in mind.

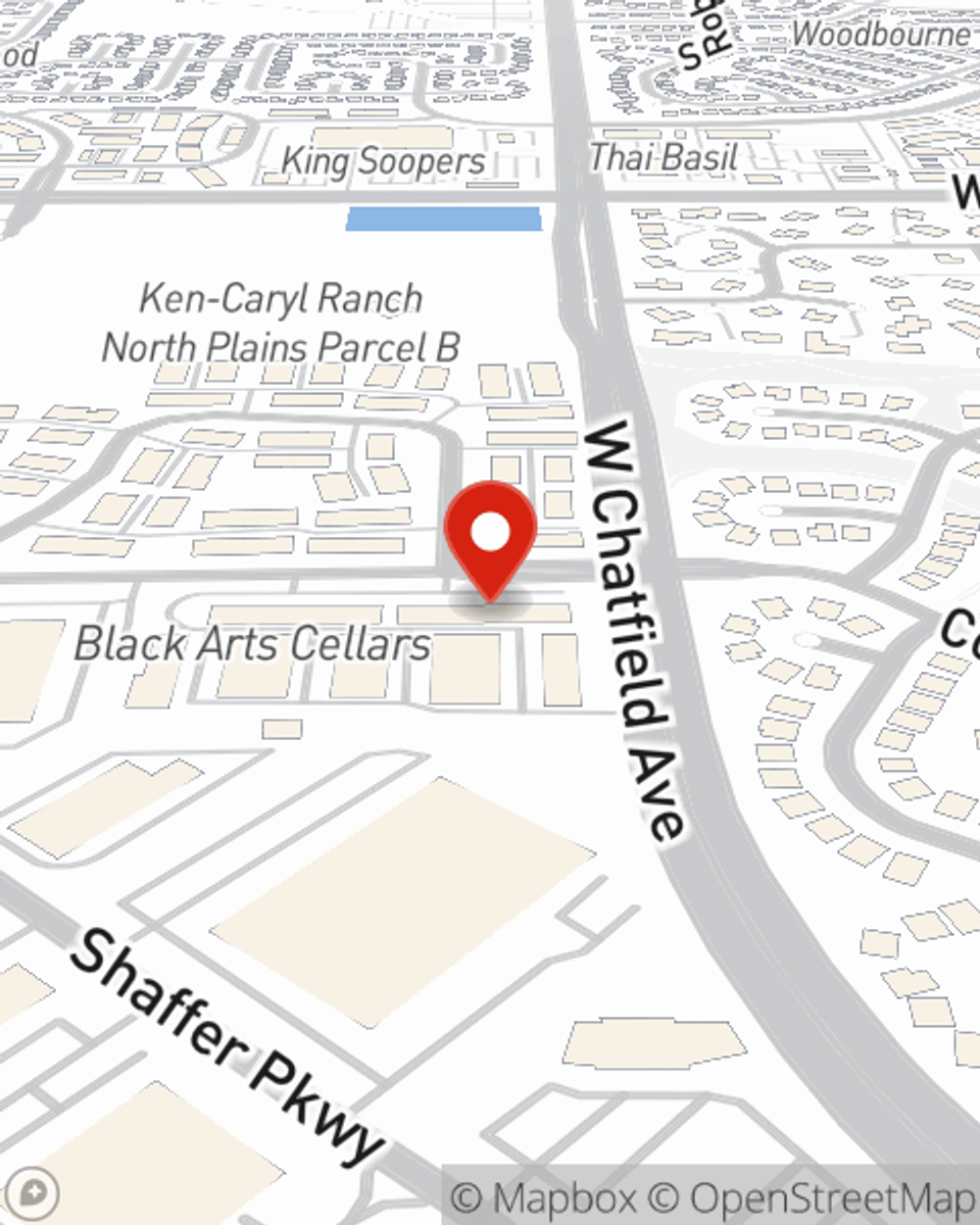

As a value-driven provider of life insurance in Littleton, CO, State Farm is committed to be there for you and your loved ones. Call State Farm agent Travis Rodgers today and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Travis at (720) 512-5876 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Travis Rodgers

State Farm® Insurance AgentSimple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.